Personal Insurance companies are stuck between a rock and a hard place when it comes to user experience. Oliver King, co-founder of Engine, puts it into perspective:

Insurance suffers from two key problems in terms of customer experience. It’s a product people are obliged to have rather than want. Plus, on the rare occasions they do interact with the provider, it normally has negative connotations.

So how do insurance companies engage with both new and existing customers when the tide is firmly against them? This post details how we put ourselves into the customer’s shoes to try and tackle this very question.

Technology?

We started by looking at how technology could be used to gather information and relay this to the customer’s insurer. Most people nowadays have a huge array of sensors carried on their body and networked within their home and we thought we could take advantage of that.

By researching information that could be populated via these sensors, we started to evolve small insights combining certain device’s functionality and the information certain policies require. Contents insurance premiums could be calibrated based on exact data gathered from automated assistants about when policy holder’s homes are actually occupied. Customer’s car insurance premiums could alter if GPS data from their phone indicated they were doing less city driving. Life insurance providers could tap into the wearables market and adjust policies according to their subscriber’s health and fitness.

However, it quickly became clear that we were trying to force technology into the picture, when the problem may not actually require it. Yes, insurers could eventually engage with customers on this level but what about right now?

We would like a quote!

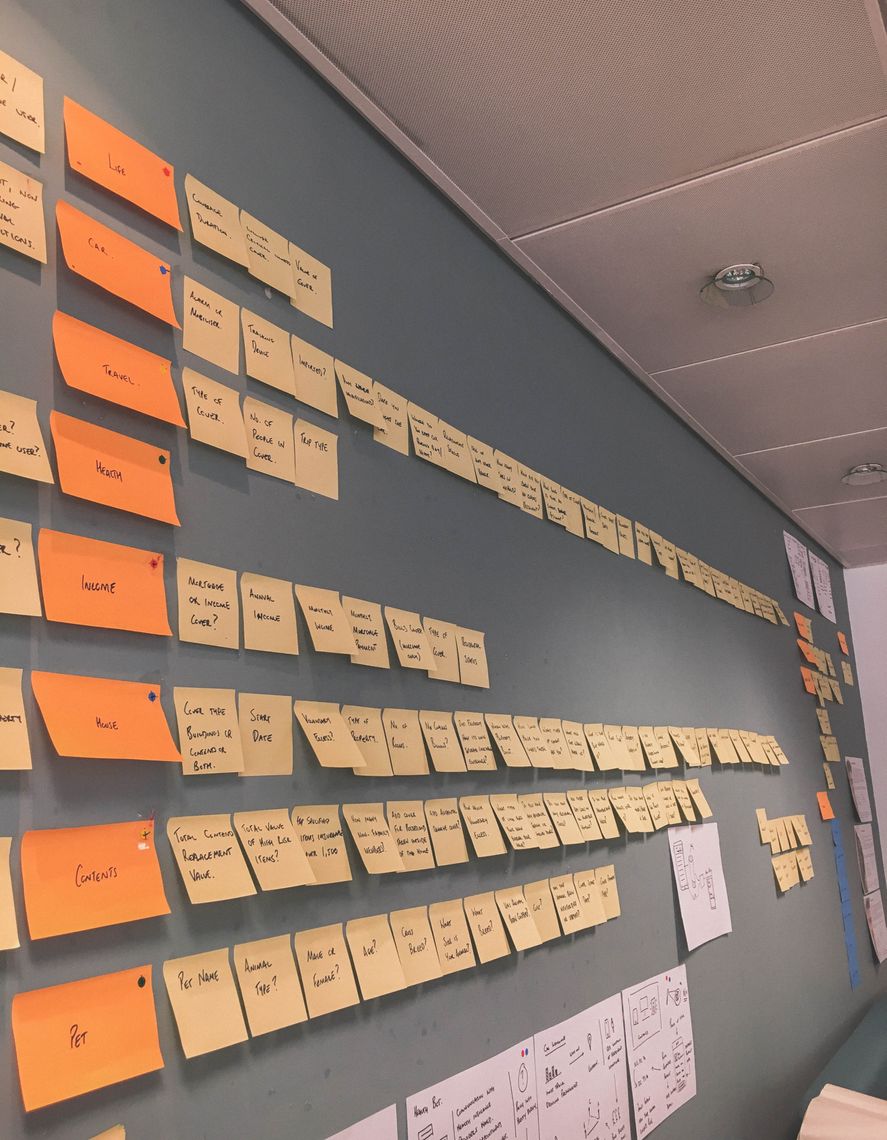

Instead, we looked to further understand what was contributing to the negative experience customers were experiencing around insurance. We focused on the first direct interaction customers have with an insurer: getting a quote. This, of course, meant that we had to apply for insurance, and lots of it. Split across eight personal insurance products (Life, Travel, Health, Income, Home, Contents and Pets) we documented every field that we were asked to complete before returning a quote. We quickly found this can amount to thirty-five plus questions in return for one car insurance quote, with the average across all policies coming in at almost twenty separate pieces of information needed. Even with comparison sites mitigating (some) of the need for re-entry across separate companies, it was no surprise that customers are lethargic before they even pay the first premium.

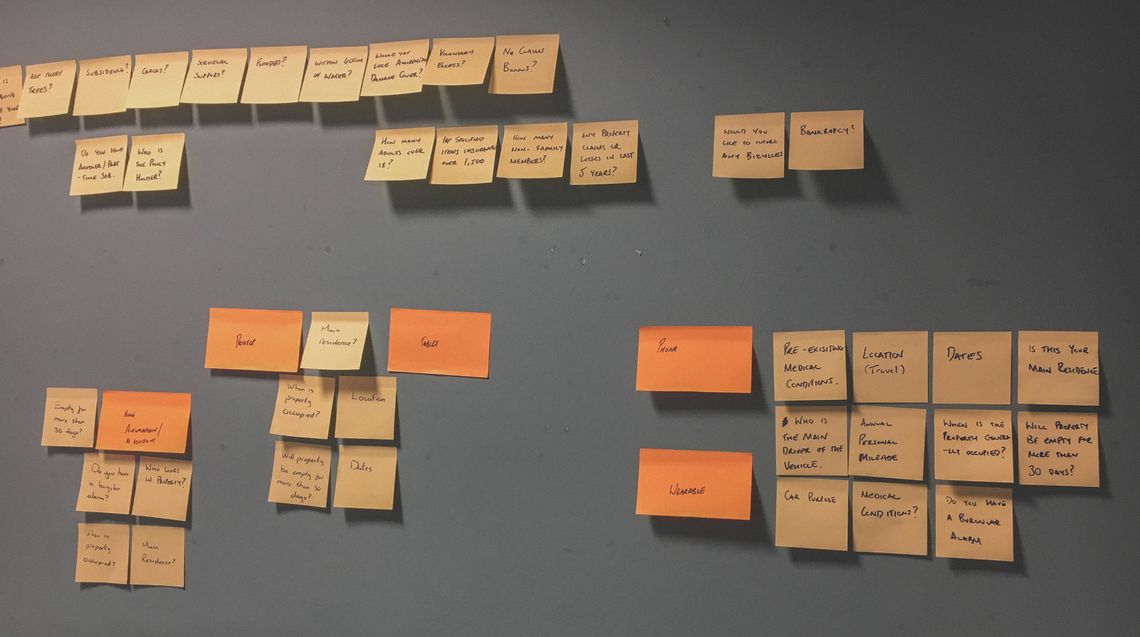

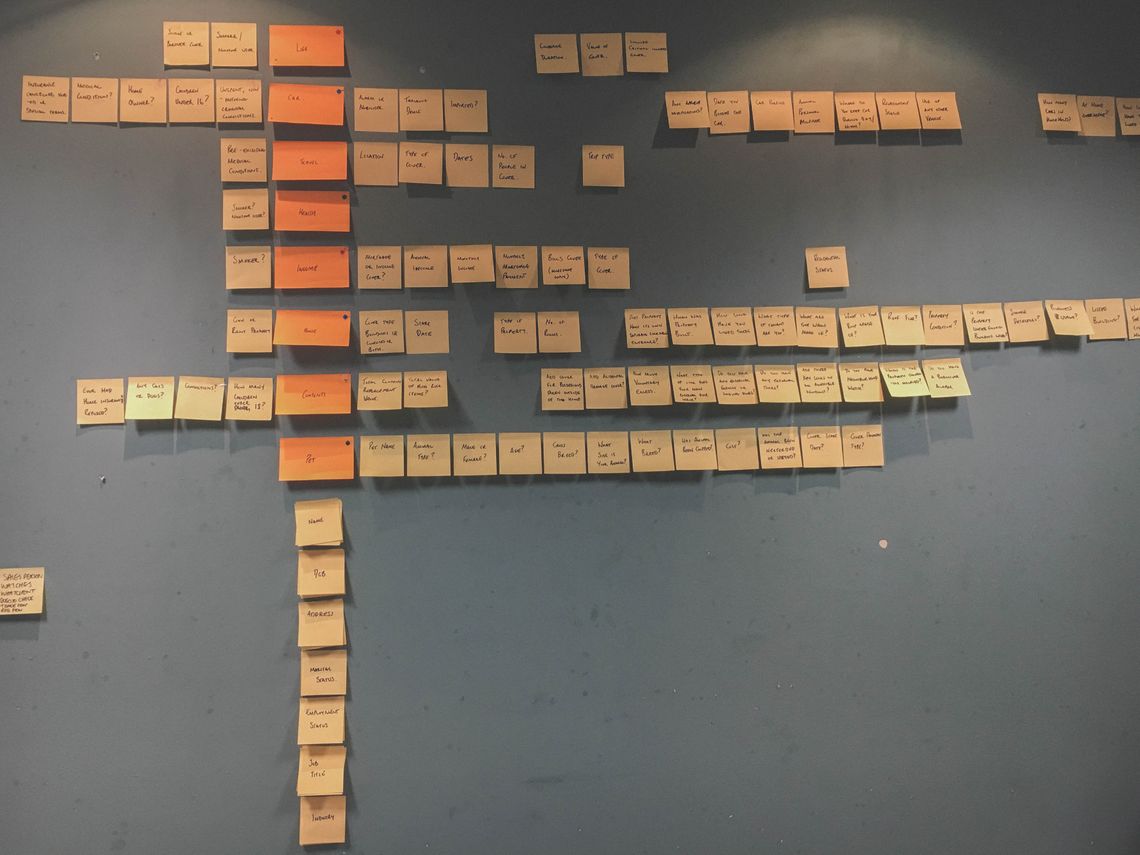

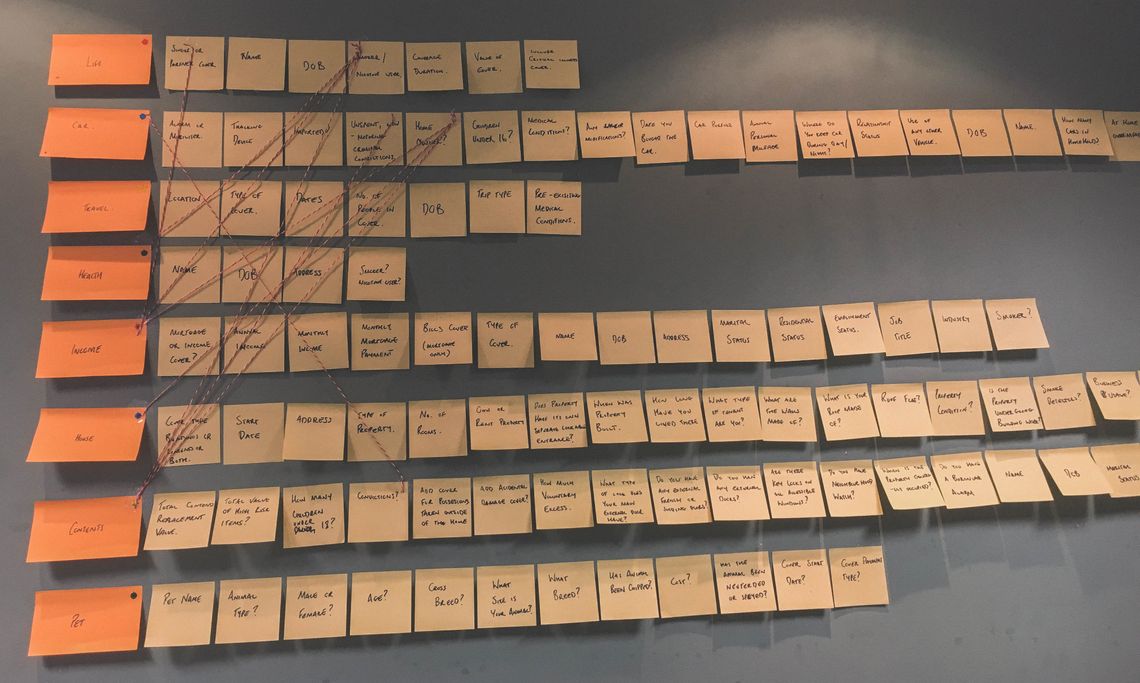

We decided to illustrate how this process felt from the customer’s perspective. The entire process until now had been guided by the provider and we wanted to move forward with the user in mind rather than reflecting on the insurer’s point of view. Do to this we had the idea of gathering all the questions as a whole and to begin matching duplicates across policies. This meant taking over the UX department’s wall and sticking up one question per Post-It for each type of insurance. As expected there were core questions that appeared for all policies such as name, date of birth, address, marital status, employment status, job title and industry. However, once this ‘core profile’ is removed we were able to visualise (with string) the less obvious crossovers.

This map of interconnecting questions pinpointed the similar required information that appeared across several policies. For example, someone with pet insurance will have to declare their pets when applying for contents insurance. If you are a smoker, not only will your life and health insurance policies be affected but your income premiums will also be hit. While being a homeowner – with a mortgage that requires home insurance – often entitles you to a discount on your car insurance.

A lot can change in a person’s life over the period of a year and even one change can have an impact over several policies. What services could insurer’s explore that encouraged their customers to update their records so that in return they could receive more accurate quotes and uninterrupted cover? Ultimately we wanted to know if there was a way to save people from answering these similar questions repeatedly across multiple policies?

How a customer perceives your product

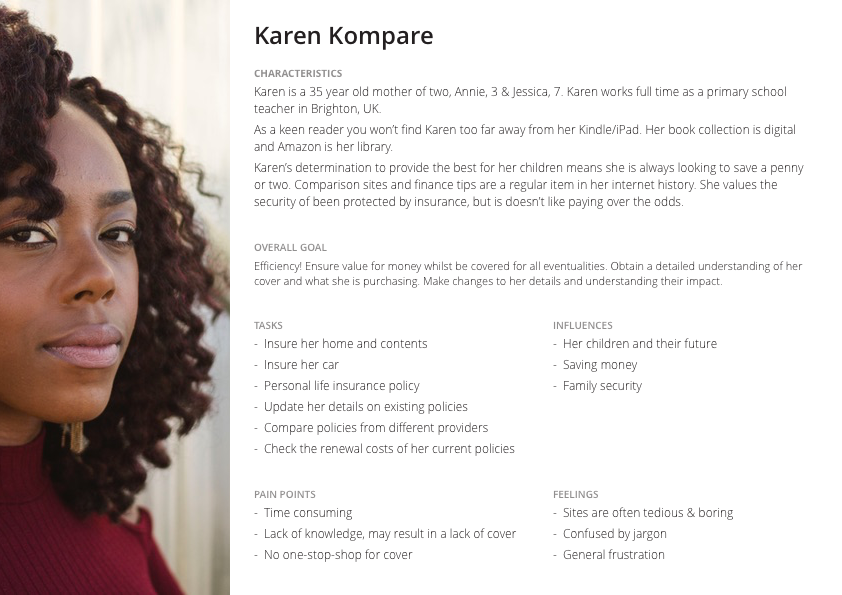

Our next step was to develop some proto-personas – personas that encapsulate our understanding of who is using a company’s services – to empathise with different customers and understand how they may view their insurance provider. One persona was completely new to insurance, another used comparison sites to search out the best deal while the third was loyal to one company. This step allowed us to understand that while a company may view itself as vastly different to its competitors, we as customers rarely see it that way. There are people, for example, that view travel insurance as a catch all name for an identical product, sold by different companies with the only variable being price. Many people find themselves like our persona Karen above, using a comparison site to get the cheapest cover while not understanding the intricacies between the products on offer.

Customers need to know how the policies relate to them

We now have two questions with which to push forward our research,

- Are there opportunities for insurers to educate potential and current customers about the intricacies between their products?

- Can insurers create more meaningful touch points that would encourage customers to keep their information up to date?

We came to the conclusion that if Karen, a single mum with little spare time, was able to go to one single place and keep her details up to date then this place could also be used by insurers to improve the service provided to her. A hub like this could be used to illustrate her family’s existing cover, visualise the interconnecting nature of her policies and allow insurers to utilise her up to date details. If we use the previous example of adding a pet insurance policy to her account, Karen could instantly be shown how this would affect her contents insurance premiums. Karen can now act with all the information that was previously unavailable to her, allowing her to make an informed decision whether or not to proceed. If she does choose to proceed her contents policy can be automatically updated with no risk to her losing cover.

Alternatively, Karen could mention she has a pet when applying for contents insurance. That data can then be converted into relevant pet insurance policies, displayed and tailored around her needs as a cross sell. As engagement increases with her insurer, and more opportunities for positive interactions appear, so will her brand loyalty. This is just one example of how addressing the customer’s experience could deliver tangible returns to the insurer’s themselves.

Think about the future but don’t forget the present

The future of insurance is an exciting one. The trends being discussed throughout the industry have the potential to really turn the tide of negativity. More data is already being collected and processed through the internet of things, with more accurate and tailored products being released all the time. Even engagement is beginning to increase with the use of methodologies such as gamification and the increased popularity of mHealth apps linking to people’s risk profiles.

However, these trends are very much focused on the future and what we don’t want to do is force technology into the solution causing us to forget about the present. As we have talked about, there are some directions the industry can move in right now to tackle the customer experience. It’s now up to the industry if they want to make this move.