Why the smartest investors are finding that sustainability isn’t a trade-off, it’s actually a competitive advantage.

The narrative around sustainability has too often been dominated by compliance costs and regulatory burden. But this framing misses the bigger picture. The most successful companies aren’t just ticking regulatory boxes; they’re using sustainability as a lens to unlock operational efficiencies, reduce costs, and create entirely new revenue streams.

The False Choice Between Returns and Responsibility

Traditional thinking positions sustainability as a cost centre: more reporting, higher operational expenses, constrained investment choices. This creates an artificial tension between doing good and performing well. But our work with portfolio companies tells a different story.

Take technology infrastructure, often one of the largest operational cost centres for modern businesses. Most organisations could reduce their cloud spending by 20-30% tomorrow simply through actions like rightsizing underutilised resources. When this is framed this through a sustainability lens rather than pure cost reduction, we see higher engagement from teams and more sustained behavioural change.

The Tech Carbon Standard we’ve developed reveals where the real hotspots lie. Surprisingly, for many businesses it’s not the servers, but the end-user hardware refreshed every two to three years. Extending device lifecycles from three to four years can deliver immediate OPEX savings whilst dramatically reducing environmental impact.

Reimagining Infrastructure: The Nursing Home Data Centre

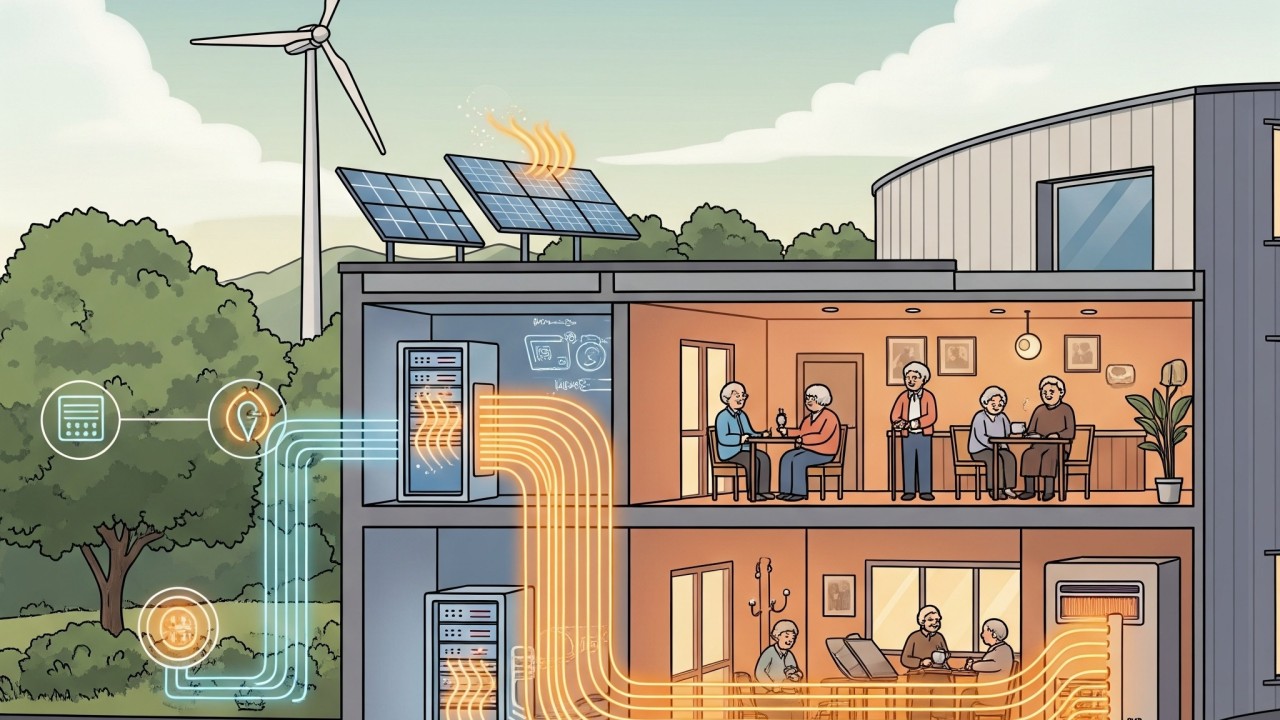

But the real value creation happens when sustainability thinking leads to fundamental business model innovation. Consider the data centre industry, traditionally a capital-intensive business with enormous cooling costs.

Novel hosting companies (including Heata, Civo/ Deep Green and Leafcloud) have turned this model on its head. Instead of building isolated data centres that waste heat through air conditioning, they place servers directly in buildings with consistent heating demand, specifically care homes, residential buildings and swimming pools. The waste heat from computation becomes the primary heating source - often displacing expensive and polluting Gas.

The economics are compelling: rather than paying data centre rent plus cooling costs, they’re effectively paid to provide compute capacity through the value of waste heat recovery. One operator told me: “I literally pay my server space rent with waste heat. It’s like barter.”

This model offers multiple value creation opportunities:

· Operational arbitrage: 50-70% lower infrastructure costs compared to traditional data centres

· Revenue diversification: Heat-as-a-Service creates recurring revenue streams

· ESG positioning: Genuine sustainability credentials rather than offsetting (in many cases carbon negative - as electricity powers compute and heating displacing gas).

· Regulatory resilience: Future-proofed against carbon pricing and efficiency requirements

The Multiplier Effect

The pattern repeats across sectors. In manufacturing, industrial symbiosis (where one company’s waste becomes another’s input) creates new revenue streams whilst reducing disposal costs. In logistics, route optimisation for carbon reduction simultaneously cuts fuel costs and improves delivery times.

These aren’t just efficiency gains, they are a fundamental reimagining of how value is created and captured. Companies that embed sustainability thinking into their core operations often discover competitive advantages that weren’t visible through a purely financial lens.

Investment Implications

For private equity, implementing this shift requires taking a different approach to due diligence and value creation planning:

Due Diligence: Map operational carbon hotspots alongside cost centres. The biggest sustainability impacts often reveal the biggest cost reduction opportunities.

Value Creation: Use sustainability frameworks to identify business model innovation opportunities, not just operational improvements.

Exit Positioning: Companies with embedded sustainability advantages command premium valuations as ESG becomes table stakes for strategic buyers.

Risk Mitigation: Future regulatory costs (carbon pricing, efficiency standards) become predictable rather than existential threats.

The Bottom Line

The most successful companies we work with don’t see sustainability as constraining their operations; they view it as expanding their opportunity set. When things like waste heat becomes a revenue stream, when energy efficiency drives competitive advantage, when circular business models create customer stickiness, sustainability stops being a cost and becomes a source of value.

The choice isn’t between returns and responsibility. It’s between conventional thinking and innovative value creation. In an environment where regulatory requirements are only tightening and stakeholder expectations are rising, the companies that crack this code first will have built-in competitive advantages that are hard to replicate.